Venmo, a mobile payment service owned by PayPal, has transformed the way we handle money, making transactions between friends, family, and even select businesses easier than ever. Whether you’re splitting a dinner bill, paying rent, or sending a birthday gift, Venmo offers a convenient and user-friendly platform. This comprehensive guide will explore everything you need to know about how to use Venmo, from setting up your account to safeguarding your transactions.

Setting Up Your Venmo Account

Downloading and Registering

The first step to using Venmo is to download the app from the App Store or Google Play. After installation, you’ll need to create an account. You can sign up using your email address, Facebook account, or mobile number. Venmo will then guide you through a series of steps to verify your identity, which is crucial for security and compliance with financial regulations.

Linking Your Bank Account or Card

Once your account is set up, the next step is linking it to a bank account or debit/credit card. This is essential for transferring funds into your Venmo balance and making payments. To link your bank account, you’ll need to provide your account number and routing number. For debit or credit cards, the card number, expiration date, and CVV are required. Venmo uses encryption to protect this information, ensuring your financial data is secure.

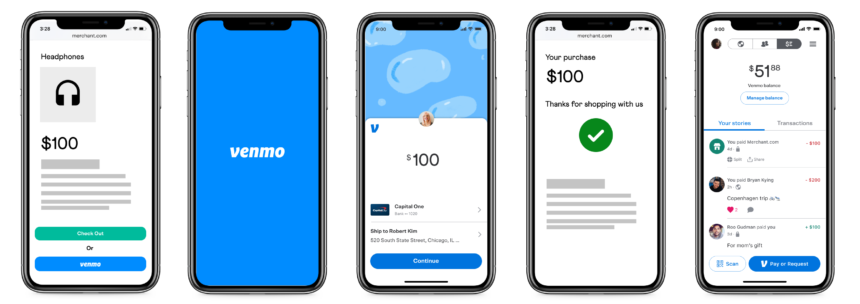

Navigating the Venmo Interface

Understanding the Main Tabs

Venmo’s user interface is designed for simplicity and ease of use. The main screen is divided into three tabs:

- Pay & Request: This is where you can send money or request payments from other Venmo users. Simply enter the recipient’s username, phone number, or email, specify the amount, and add a note describing the transaction.

- Purchases: Here, you can track your spending on Venmo, including payments you’ve made and received. It’s a handy feature for managing your finances and ensuring you’re on top of your transactions.

- Me (Your Personal Venmo Feed): This tab shows your transaction history, friends list, and the public feed, where you can see transactions among other Venmo users. You can customize your privacy settings to control who sees your transactions.

Making and Receiving Payments

To send a payment, go to the “Pay & Request” tab, type in the recipient’s username, and enter the amount. You can add a note to remind yourself and the recipient what the payment is for. Once you hit “Pay,” the funds are transferred instantly from your Venmo balance, bank account, or linked card to the recipient. If you’re receiving money, it will appear in your Venmo balance. You can then transfer it to your linked bank account or use it for future transactions.

Maximizing Venmo’s Features

Splitting Bills

One of Venmo’s most popular features is the ability to split bills with friends or family. When you’re out dining or sharing expenses, Venmo calculates each person’s share of the total cost. Everyone involved can then pay their portion through the app, simplifying the process of settling shared expenses.

Social Interactions

Venmo stands out from other payment services by incorporating social features. Users can like and comment on friends’ transactions, which appear in the feed (depending on privacy settings). This adds a fun, interactive element to the otherwise mundane task of money transfer.

Safeguarding Your Venmo Account

Privacy Settings

Venmo allows you to control who sees your transactions. You can choose between public, friends-only, or private settings. For most users, setting transactions to “friends-only” offers a balance between social interaction and privacy.

Security Measures

It’s important to treat your Venmo account like a bank account. Use a strong, unique password, enable two-factor authentication, and never share your login details with others. Venmo also offers PIN code and biometric login (fingerprint or facial recognition) for added security on mobile devices.

Troubleshooting Common Issues

Lost Phone or Suspected Fraud

If you lose your phone or suspect fraudulent activity on your account, contact Venmo immediately to freeze your account. Venmo’s support team can help secure your account and guide you through any necessary steps to protect your finances.

Transaction Limits

Venmo has weekly rolling limits for transactions, which can sometimes catch users by surprise. If you’re planning to make a large purchase or need to send a significant amount of money, check Venmo’s limits in advance to ensure your transaction goes smoothly.

Conclusion

Venmo offers a seamless way to manage money and share expenses, combining the practicality of digital payments with the social dynamics of a connected world. By following this guide on how to use Venmo, from setting up your account to making the most of its features while staying secure, you’ll be well-equipped to navigate the world of mobile payments. Whether you’re splitting bills, paying for services, or just sending money to friends and family, Venmo provides a convenient platform to do so with ease and confidence.

Read Also: Gordon Ramsay: The Culinary Maestro