Navigating the complexities of tax obligations can be daunting for many, especially when it comes to understanding the nuances of unique taxpayer reference numbers, commonly known as UTR numbers. In this comprehensive guide, we’ll delve into everything you need to know about obtaining your UTR number, ensuring you’re well-equipped to manage your tax affairs with confidence.

Understanding UTR Numbers

Before we embark on the journey of obtaining a UTR number, it’s crucial to understand what it is and why it’s important. A UTR number is a 10-digit code assigned by HM Revenue and Customs (HMRC) in the UK to uniquely identify taxpayers who need to manage their tax obligations beyond just paying through PAYE (Pay As You Earn). This includes self-employed individuals, company directors, and others who need to file a Self Assessment tax return.

Having a UTR number is the cornerstone of managing your tax affairs efficiently. It’s used by HMRC to track your tax submissions and payments, making it an essential component of your tax identity.

Eligibility for a UTR Number

Not everyone needs a UTR number, so it’s important to first assess whether your financial and employment status requires one. Generally, you’ll need a UTR number if you’re self-employed, a partner in a business partnership, or have other forms of untaxed income that necessitate filing a Self Assessment tax return. If you’re solely an employee and don’t have other sources of untaxed income, you likely won’t need a UTR number.

How to Apply for a UTR Number

Registering for Self Assessment

The primary pathway to obtaining a UTR number involves registering for Self Assessment. This process can be initiated online through the official HMRC website. You’ll need to provide personal details, information about your business or income source, and possibly some additional documentation depending on your specific circumstances.

Once you’ve successfully registered for Self Assessment, HMRC will automatically issue a UTR number. This process can take up to a few weeks, so it’s advisable to register well before the Self Assessment deadline to avoid any last-minute hassles.

After Registration

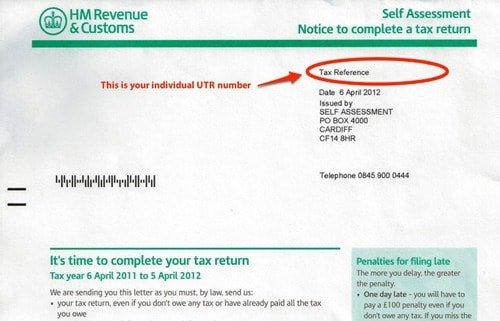

After you’ve registered, you’ll receive a letter from HMRC containing your UTR number. It’s crucial to keep this number safe, as you’ll need it for all future correspondence with HMRC and for filing your tax returns. If you’ve registered online, you might also find your UTR number in your HMRC online account.

Common Issues and Solutions

Delays in Receiving Your UTR Number

Sometimes, there might be delays in receiving your UTR number due to processing backlogs or incomplete applications. If you haven’t received your UTR number within a few weeks of registering, it’s a good idea to contact HMRC directly to check the status of your application.

Lost UTR Numbers

If you’ve misplaced your UTR number, don’t panic. You can find it in previous tax returns, official correspondence from HMRC, or by logging into your HMRC online account. If all else fails, contacting HMRC directly can help you retrieve your lost UTR number.

Keeping Your UTR Number Secure

Your UTR number is a sensitive piece of information that should be kept secure. Avoid sharing it indiscriminately, especially online or with unverified sources, to prevent identity theft and fraud.

Conclusion

Obtaining a UTR number is a straightforward process, but it’s surrounded by critical details that demand your attention. Whether you’re stepping into the realm of self-employment or navigating other paths that require a deeper engagement with your tax obligations, having a UTR number is indispensable. By following the steps outlined in this guide and staying vigilant about the security of your personal information, you’ll be well on your way to managing your taxes more effectively and with greater peace of mind. Remember, the key to a smooth tax experience lies in understanding the requirements, acting promptly, and maintaining open communication with HMRC.